child tax portal still says pending

The 16000 limit would be used to compute your credit unless you have already excluded or deducted dependent care benefits paid to you or on your behalf by your employer. Know history theme.

Here S How To Opt Out Of The Child Tax Credit Payments

Millions of families who werent required to file a full federal tax return but are still eligible for the Child Tax Credit or missing stimulus payments from last year can finally claim those tax benefits starting this week.

. If you are a parent paying child support and owe arrearages the tax intercept will still occur. We welcome your comments about this publication and suggestions for future editions. I have 4 children under the age of 12 and havent received any payments for the CTC payments.

Income-tax officials a raided Dainik Bhaskar as reporting on govts Covid mismanagement. Why is my CTC Eligibility still pending. The IRS has not announced a separate phone number for child tax credit questions but the main number for tax-related questions is 800-829-1040.

You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. TODAY National Girl Child Day 2022. Chicago Public Schools says the personal information of more than a half-million district students and staff was compromised in a ransomware attack on a district vendor last December May 22 May 21.

Any Georgia court order issued after 1993 establishing child support amounts should provide for support to continue until the child turns 18. I need to cancel my current direct deposit. Tax refund intercept occurs when a tax filing is completed.

While retroactive payments were made or caught-up for stimulus checks missing eligible payments for the CTC were. In this situation you should list 16000 for the 3-year-old child and -0- for the 11-year-old child. 0611 Policy flip-flop over coal import puts state private gencos in a spot 0610 Indias aversion to Chinese investments and how geopolitics impacts PLI 0610 PM Modi may hold first in-person meet of NITI Aayog since 2019 soon 0604 Centre likely to.

Despite three rounds of dependent stimulus checks and the advance monthly child tax credit CTC paid in 2021 many tax payers are still waiting to be paid and are relying on their 2021 tax filing to get missing payments for their eligible dependents. My child is still in school. I filed through Turbo tax and everything expected was received.

5 a child-in-law of the owner or. If the child is still in high school past the age of 18 support will continue until the child finishes high school or reaches the age of. NW IR-6526 Washington DC 20224.

3 the owners parent or an ancestor of the owners parent. As I said earlier you must have UAN number mobile number and password to login to UAN portal. I filed all 4 of my kids on my 2020 taxes and gotten all 3 of the stimulus checks.

1 a natural or adopted child or descendant of the owners child. Why has child support stopped. IRS website still says pending for eligibility.

2 a stepchild of the owner. Kerala TN asks Centre to drop amendments to IAS Cadre rules it will create fear psychosis. EPFO UAN portal gives you the option to change your mobile number under the Profile menu.

However since you are required to have your support electronically deposited you will need to provide a new direct deposit account or. If you dont remember your password or have changed your mobile number then you have to create a new password update your mobile number. Last year taxpayers were given extra time as the covid-19 pandemic was still gumming up the works which left the IRS with a staggering backlog of tax declarations to.

6 a natural or adopted sibling of the owner. 4 a stepparent of the owner. You can cancel your current direct deposit by called 888-965-2676.

The federal tax filing deadline has been extended from April 15 2021 to May 17 2021. Due to the tax filing extension intercepted tax refund payments may be delayed. Twitter buyout deal on hold due to pending details on spam and fake accounts.

A qualified family member includes only. Instead of calling it may be faster to check the.

H R Block A Portion Of Your Child Tax Credit Payments Ctc Will Now Be Distributed Through Advance Payments That Means If You Want To Opt Out Of These You Ll Need To

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

Irs Child Tax Credit Payments Start July 15

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

What To Do If You Still Haven T Received Your Child Tax Credit Payment Forbes Advisor

9 Reasons You Didn T Receive The Child Tax Credit Payment Money

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

Why Is My Eligibility Pending For Child Tax Credit Payments

Gop Tax Overhaul How Long Island Homeowners Will Be Affected Housing Market Mortgage Homeowner

Child Tax Credit August Update How To Track It Online Marca

Child Tax Credit Updates Why Are Your October Payments Delayed Marca

Irsnews On Twitter There Have Been Changes To The Child Tax Credit For 2021 And The Credit Amounts Will Increase For Many Taxpayers Learn More From Irs At Https T Co 535gr8fjvp Https T Co Bgyzn36d4v Twitter

Child Tax Credit 2021 Irs Chief Warns Payments May Be Delayed Abc11 Raleigh Durham

Didn T Get Your Child Tax Credit Here S How To Track It Down Gobankingrates

Missing A Child Tax Credit Payment Here S How To Track It Cnet

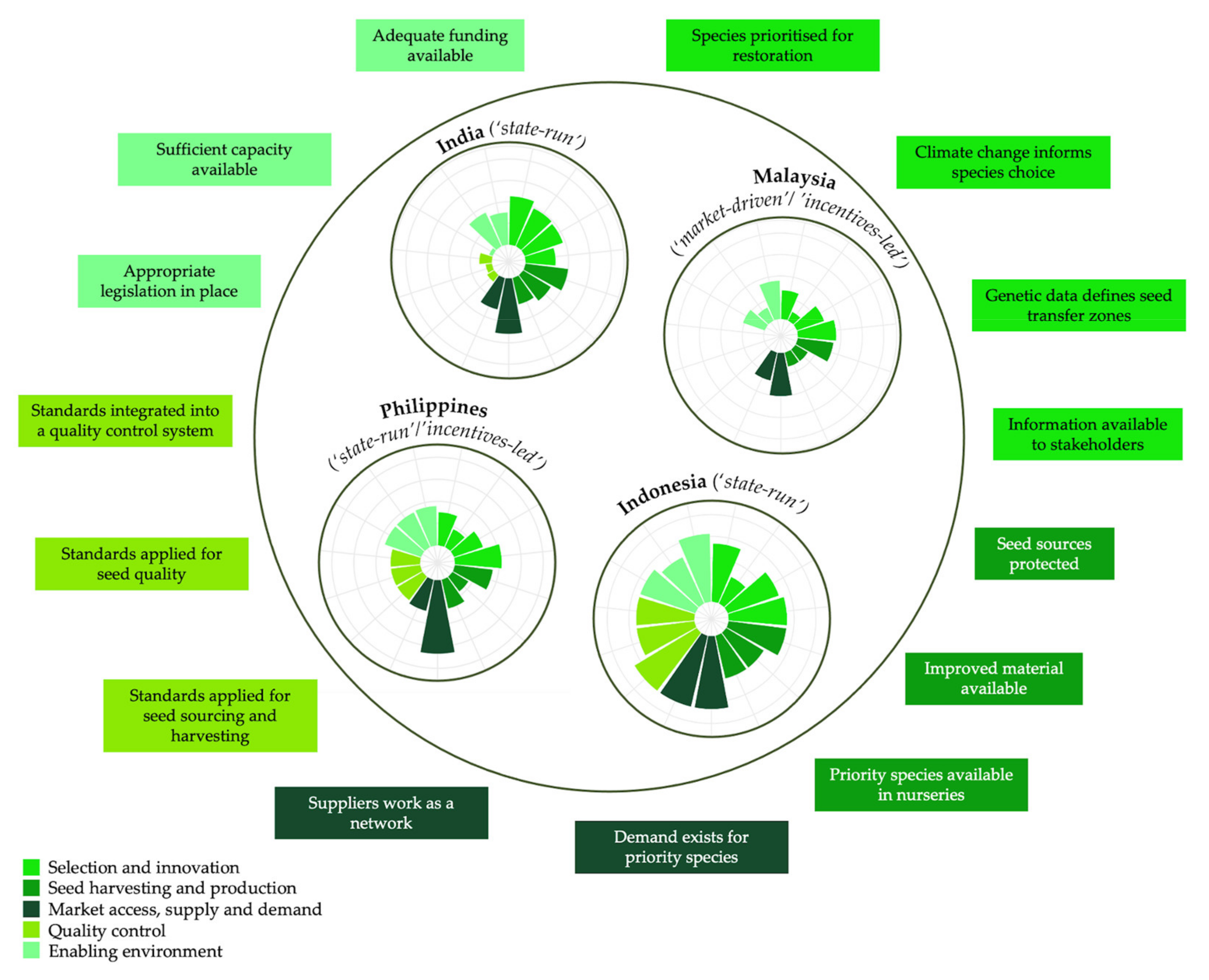

Diversity Free Full Text Are Tree Seed Systems For Forest Landscape Restoration Fit For Purpose An Analysis Of Four Asian Countries Html

Child Tax Credit Will There Be Another Check In April 2022 Marca

Pin By Chandrashekhar On Master Tax Return Times Of India Change

Hra Exemption Calculator Income Tax Tax Refund Income Tax Return